Spread your mortgage payment out over the course of a month, pay your loan off faster and potentially save thousands in interest using our Payment to Payoff program. There is NO fee to enroll, and it is eligible with most loans.

The Payment to Payoff Program allows you to pay on your mortgage every two weeks. Each payment is equal to half of your monthly mortgage payment. Not only is it a budget friendly option, it could potentially save you thousands of dollars in interest over the life of the loan.

How It Works

A bi-weekly payment plan uses the calendar year to your advantage. By paying half of your mortgage payment every two weeks, you make 26 payments per year instead of 12. Because some months are longer than others, you end up making an extra monthly mortgage payment over the course of the year. (The 26 bi-weekly payments equal 13 monthly payment equivalents in a year.) Translation: by making an extra monthly payment each year, you pay your loan off faster and may save money in interest!

While monthly payments are easy to remember, you usually end up paying more interest over the life of your loan when you make one payment a month versus paying every two weeks.

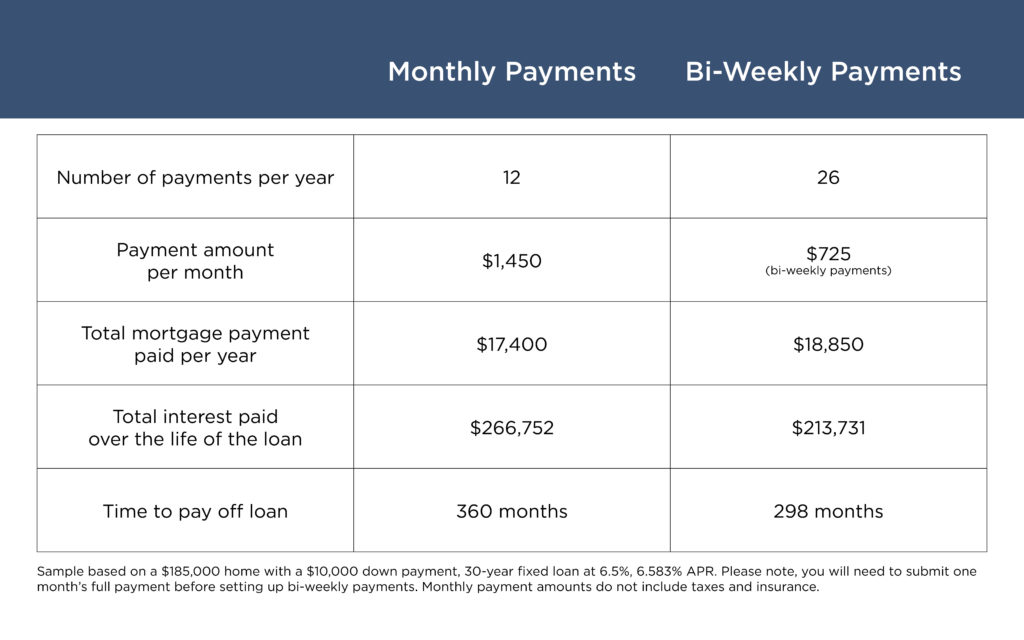

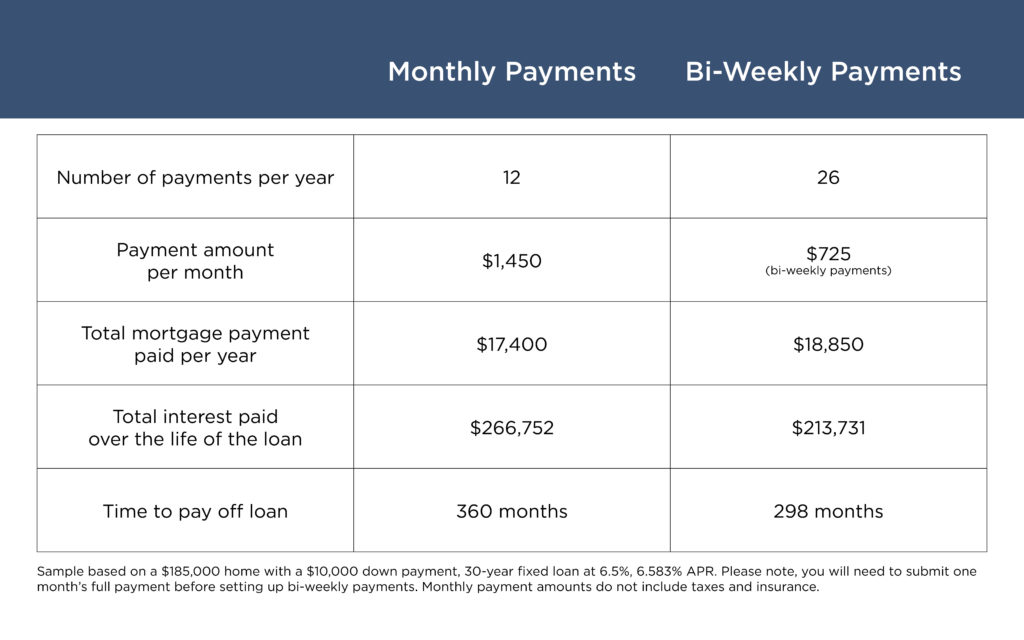

Consider this scenario:

Your monthly mortgage payment is $1,450. If you pay monthly, you will pay $17,400/year. If you pay bi-weekly, you will pay $725 every two weeks, which totals $18,850/year. Bi-weekly payments allow you to save $53,021 in interest and shave five years off the loan!

Advantages of Bi-Weekly Payments

Please note: You will need to submit one month’s full payment before setting up bi-weekly payments. For example, December 1st payment must be paid and then in the month of December you must make two bi-weekly payments for the January 1st due date. Once that is complete, you can move to bi-weekly payments.

Before enrolling, it’s important to review your loan terms to calculate actual savings. All changes can be completed through our loan servicing website. Our team is happy to help, so please contact us with any questions!

Application is required and subject to underwriting. Not all applicants are approved. Full documentation and property insurance required. Loan secured by a lien against your property. Fees and charges apply and may vary by product and state. Terms, conditions and restrictions apply, so call for details. FirstBank Mortgage provides a variety of loan products with different rates, payments and fees. All loans are subject to credit approval. Products and services offered by FirstBank. FirstBank Mortgage is a division of FirstBank. FirstBank Institution NMLS ID 472433.